Are you prepared for bitcoin yet?

News reports show that banks, governments and asset managers are also taking bitcoin increasingly seriously.

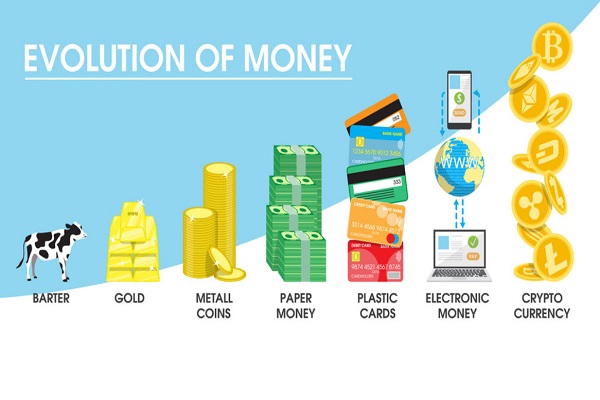

But if you want to understand why bitcoin could be the next step, you first need to know what money actually is and how it came into being. So it is important to know a bit of the history of money. To get you a bit more at home with this, we would like to share some information about the development of our money.

When something is better than the alternative, people will start using it.

– quote Bert Slagter (author “Our money is broken”) –

The history and development of money

In the beginning, money was not the same as we know it today. It went through a long process of historical change. Money is the most important invention of modern times.

Using commodities as money

In the beginning, peoples used commodities and animals as a medium of exchange. Any commodity demanded and accepted as a medium of exchange was a form of money. However, this did not work as money in a global economy.

Money must meet the following conditions and properties:

Conditions

- Money is not for consumption;

- Money should not spoil;

- Using money only as a means of payment and not for other purposes;

Properties

- Money can be split into smaller units;

- Money is easy to transport;

- Money retains its value;

- Money is difficult to destroy.

Using metals as money

With the further development of human civilisation, raw materials and animals were replaced by precious metals such as gold and silver to be used as money. With the invention of coinage, people started using coins of gold and silver as money instead of simple, insignificant pieces of gold and silver whose value was difficult to measure. Precious metals were used as money not because they were valuable, but because they were scarce. To serve as money, scarcity is more important than value. It was the main form of money during most of recorded history.

Using paper money or bank money as money

In the beginning, paper money, i.e. paper banknotes, was a simple claim to and substitute for metallic money. But with the passage of time, paper money was considered as money itself. Paper money in the form of banknotes was not a mere substitute, but was considered a supplement to the money supply. Initially, banknotes could be issued by all commercial banks, but over time, as paper money became unconvertible into metallic money, issuing banknotes became the monopoly of a country’s Central Bank. In the early days, the notes were backed by a precisely equal amount of gold or silver held in reserve by the issuing authority. These notes could be exchanged for gold or silver coins when requested and did nothing more than represent metal coins. This type of paper money or notes was therefore called representative paper money. Today, since paper money cannot be converted into gold or silver, representative paper money does not occur anywhere in the world. When the paper money issued by the Central Bank was fully backed by the reserves of gold or silver of equal value it held, this paper money system was called “Full Reserve System”.

With the passage of time, it was thought that a gold reserve of percent against the issued paper money was not necessary and instead only a percentage of 30 to 50 percent was sufficient to convert the notes presented for exchange into gold. Therefore, the “Proportional Reserve System” (or fractional banking) was introduced. This required the issuer to hold 30 to 50 per cent of the total amount of notes issued as gold reserves. A percentage of 30-50 was considered sufficient to honour the notes when they were presented for exchange into gold. This was based on the fact that people found the notes very handy and rarely thought of handing them over to the issuing authority. Therefore, full coverage with gold was not necessary.

Banknotes issued by the Central Bank of a country are “Fiat paper money”, i.e. they are issued by fiat, that is, “by order of the government”. Since they are legal tender, they are generally acceptable in exchange for goods and services. It is important to note that the “promises to pay” written on the banknotes are not “promises to pay” anything else. For these notes, only other paper notes can be given whose value would equal the face value of the note you are offering for payment.

Digital better than gold.

Why do you want to be better than gold with your scarcity? Because gold is scarce on earth, but we have no idea how much gold is actually left in the ground. We can invent digital systems that are really finite and where you really have to make an effort to reach the digital good. And that is BITCOIN.

So why bitcoin?

The main reasons why bitcoin is interesting right now:

- Bitcoin is scarce and deflationary due to the quantity limitation of 21 million and therefore not subject to inflation;

- Bitcoin is scarce and deflationary due to the quantity limitation of 21 million and therefore not subject to inflation;

- Bitcoin is a decentralised network, there is no central party that can change the recorded transactions or turn off the system;

- Bitcoin is liquid and therefore easy to trade, unlike, say, gold or silver;

- Bitcoin allows those without bank accounts worldwide to participate in economic transactions;Bitcoin can be a valuable investment class if widely accepted, it cannot be destroyed or disposed of, thereby more durable than regular fiat money and precious metals.

The above points are, in our opinion, enough reasons to take bitcoin seriously.